How to digitize a continent, or “offline” is still king

There is only one rule in the African market, dance. It works!

I recently watched a couple of videos where Bola Lawal and Kelvin Umechukwu both founders of LearnAm and Bumpa respectively were dancing in a market. It was obviously part of an offline marketing campaign, what some would call an activation campaign. But it was enough to start me thinking. Come with me.

Contrary to what you might have expected, digitization in Africa is a solidly offline affair. That is, other than social media, more people get connected digitally when the tools are unobtrusive and support substantial offline platform activity.

That is not you expect when you read all the glowing reports about smartphone penetration in Africa.

But that is where it all started.

In the beginning.

In the beginning there were two lines. The one running between crooked telephone poles from city to city and the line that formed outside the three ancient telephone booths downtown every morning.

That was until GSM happened.

The coming of feature phones, GSM networks and USSD single handedly unleashed major growth spurts in many economies in Africa. Growth sectors that to this day, both telecom companies and the businesses that are empowered by legacy GSM services (which is everyone) continue to contribute significantly to the economy of multiple African states.

The N20 per minute GSM call stands that replaced landline telephone booths and the flood of feature phones were the first signs of the Agent Economy, and how Africa would adapt and engage with digital technology going forward. At least in hindsight that is what I see. That agent economy is just one way digital inclusion in Africa had to bend over to accommodate our affinity for low-tech-human-intermediary-transactions. Plus it created jobs.

Where agents, USSD, and market squares meet “Offline” rules

Why low-tech-offline solutions still dominate the African digital experience is obvious. The alternative is mostly unaffordable in addition to being unreliable.

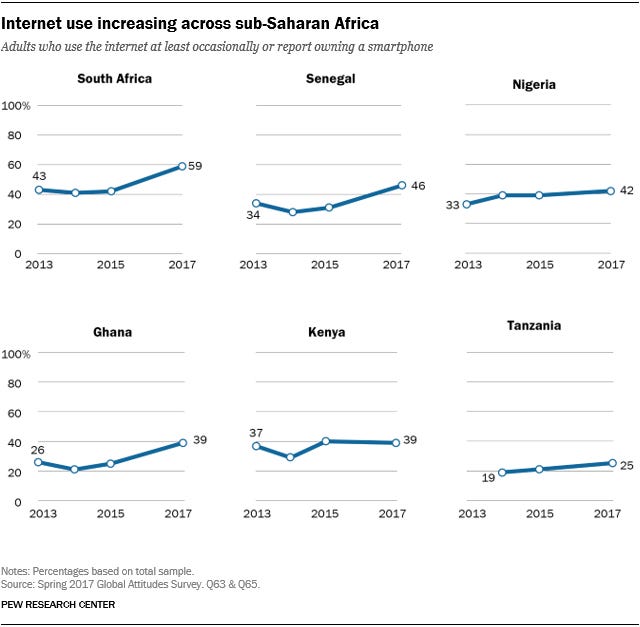

Despite all the work done, internet penetration south of the Sahara is far from the ideal. The data plans are simply too expensive and too limited and $100 smartphones can be too much of a compromise. Consequently, the Internet is still a luxury for a lot of people.

This is where the offline economy’s most significant innovation came online.

In the four African countries sampled, USSD accounted for an average of ~90%+ of financial transactions. Personally, I find Nigeria’s data intriguing as it is simultaneously the largest market (by population and economic output) and the leading destination of venture capital ($1.4bn according to Africa: The Big Deal data).

The truth again, is that, when digital tools require significantly less from a potential user, a new connection is born. For example, whether I have airtime or not, data or not, I can send money from Lagos to Kano in minutes by dialing a few numbers. What’s more? I can do it on my Infinix SMART 5, I can do it on a regular feature phone or from any phone within carrier coverage!

Similarly, mobile POS card readers are sold as necessary pieces of equipment in the fight to drive financial inclusion and digitization of commerce. Instead of helping to take commerce digital, agent banking seems like it has done the opposite! As the name implies, these agent banks are all over the place and deal with huge sums of physical cash. I can count 5 agent banks on my street (there are more) without trying.

Don’t let that fool you though. If you just think about it a little bit more, you can see that agent banks are doing a good job of bringing previously unaccounted for transaction data online. And because the companies powering these services want to get VC money, sometimes we get insight into just how much value the fraction of the market which they have captured is worth!

Indeed as Tayo Oviosu, founder of Paga writes in NewsWeek, “Africa's reputation as a leader in the adoption of financial technology is not because the region pioneered a new technology. Mobile-money operators have succeeded because they have blended technology into an existing culture and ecosystem that was "offline" and engendered trust of consumers.” He adds that we need to “leverage human interaction to build faith” in a fully digital system.

I will go one step further, especially in the light of the Central Bank Digital Currency push, and suggest that permanently embedding that offline mix as an option is still brilliant!

Ory Okolloh and cos built Ushahidi, a fantastic product with open crowd-sourced data that leveraged that crucial offline bit. There is no need to leapfrog anything, especially when our landscape offers marginal benefits for aggressive leapfrogging compared to the gaps we need to solve for.

Do you really want to take on the challenge of getting people on smartphones (1), and moving them to areas with internet coverage (2) and having them actually use the internet (3) When you can just build around user-approved tech like say, USSD? In the chart below the coverage gap reduced a lot more than the usage gap. Suggesting that more coverage is not the silver bullet.

Instead of only searching for that silver bullet, while not make use of the effective lead bullet “mix” we have now?

Obviously, as I have just found, I am not the first to talk about this, which makes it more interesting as I expect that this should be “common” sense today. Instead it sounds like we are still caught in the massive reorienting away from working offline-platform solutions.

Ultimately, we can’t all play in the metaverse, and given the scale AND opportunities of our problems, we might as well knuckle down hard and use what we can.

Dance in the market. Earn your 2k.

For a lot of startups in Africa, especially the guys with really ambitious and pivotal ideas, building is far from the soft glass ensconced life. The people you are building for like it or not are in the major street markets under the sun, except you are so niche, you want to reach only friends and family. To dance in the market does not mean literally holding dance shows of course.

It means more than anything else to be willing to leave the office and the whiteboard, and engage with the psychological reality you have to work with - that is, that the voices (including this one) you hear on social media are narrow. That your people have a language that connects effortlessly with them - offline.

While working with Kippa earlier this year, I remember users asking for an offline version of the free bookkeeping app. Because in Africa, the “market-size” you put in your pitch deck are still outside, and to reach them, you will also need to dance for them - in their market and literally if you want.

The default, not the best

That “offline” support either as marketing, service delivery or USSD self-service dictates the pace at which some of Africa’s most pivotal technology startups grow is both a bug and a feature.

It is a bug because it is obviously reaching for scale by relying on network effects. It is a feature because Bring Your Own Infrastructure is not a joke. Besides, localism is key to supporting first-stage growth and for many African companies, we are still mercifully in early days. In this continent where things go slow and change fast, being early can be a blessing.

Original feature photo credits: The Cambridge Encyclopedia of Anthropology