Nothing personifies what is undergoing the disruption you often hear about in Africa.

Not finance, mobility, or agriculture, and especially not health. Why? Because in many spaces where Africa’s new digital entrepreneurs play in, nothing significant exists to disrupt.

Not in the sense that there is a complete void. There’s not, but it is close…

The point is simple. When building solutions means largely depending on a broken system, a fickle system, or a system that naturally limits your grasp and forces you to depend on premature “expansion” or a race to the bottom, the word “disruption” easily feels abused and battered.

And the reality is that is where many African startups both formal and informal start from - by building the ground on which they hope to grow.

Take RelianceHMO for example, the Nigerian health insurance company is making health insurance accessible in ways that no traditional HMO is doing. RelianceHMO’s most significant work, however, is not in being “tech-first”. Instead, RelianceHMO is helping to unlock the conversation about insurance, especially health insurance. Specifically, RelianceHMO markets itself as the pocket-friendly must-have for Nigeria’s growing social media savvy youth, who in turn purchase plans for their family members, or introduce their parents to it.

RelianceHMO’s combination of TikToks, Instagram Reels, and social media influencer marketing is warming Nigerians to insurance. In that sense, the disruption is not in the product, but in creating the demand and shaping perception about what insurance means.

By making insurance social, RelianceHMO has done more to disrupt the perception of the insurance market than its proprietary technology has done to make insurance accessible. Why? Because people were not buying insurance because of poor-to-no technology. We were not buying insurance because of the bizarre social taboo around the topic. Reliance HMO’s real disruption was making the conversation about insurance normal.

It would be interesting to find out if Reliance’s VC backers knew they were investing not in tech or data, but in conversations.

A new kind of innovation

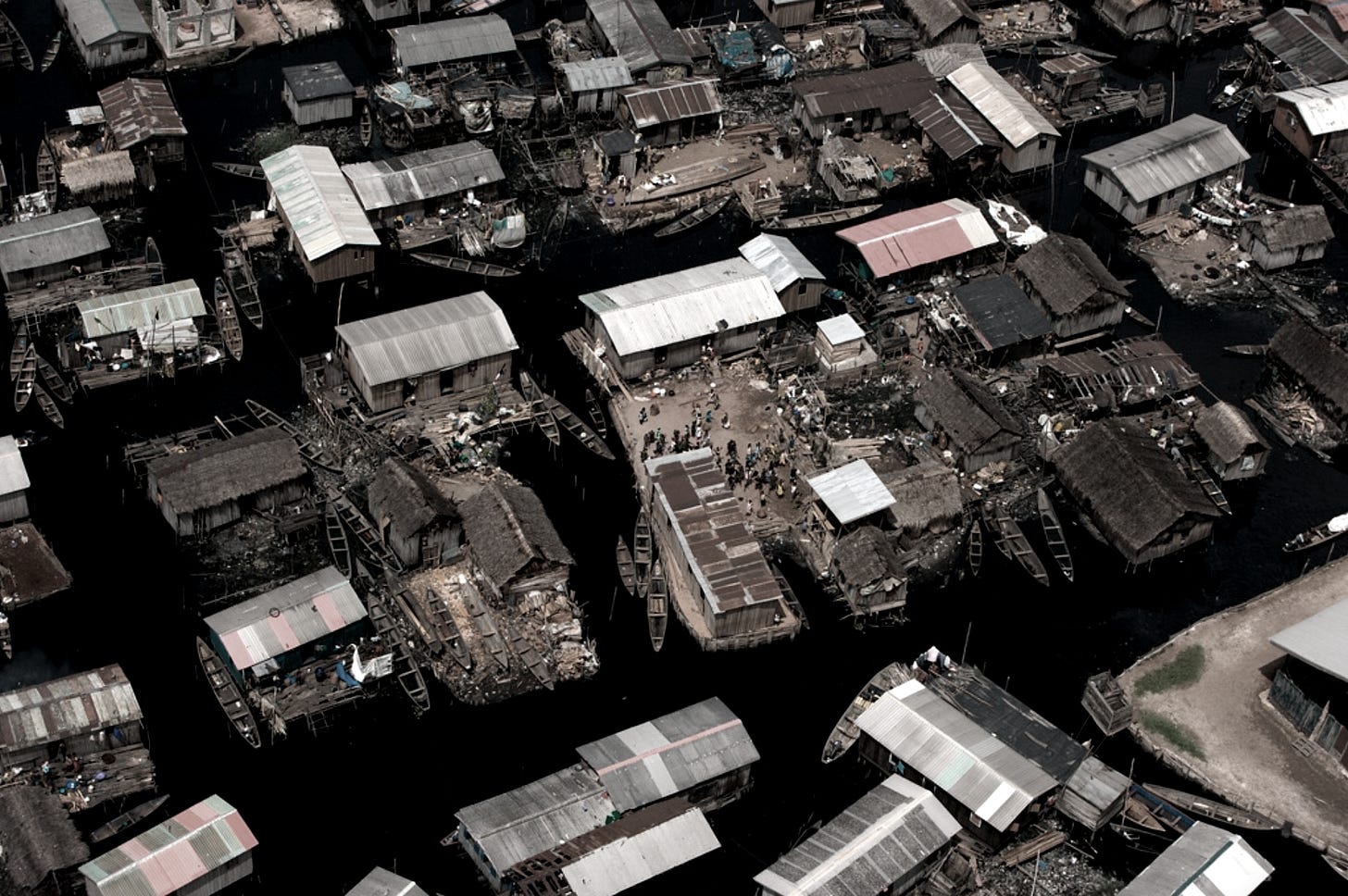

The Makoko slum in Lagos Nigeria is more famous than its residents can conceive it of ever being. Dubiously dubbed the Venice of Nigeria (I kid you not), the slum sits across a roughly one-square kilometer of black water, floating plastic, old canoes, and an eternal cackle of voices engaged in work, loud conversations, and the camera clicks of the occasional do-gooders who come for the pictures.

Makoko has some global recognition, but what that global recognition won’t do or hasn’t done is replace the rotting sticks that keep the small Lagos “suburb” afloat. Foreign dollars cannot solve a problem an unwilling government does not want to talk about.

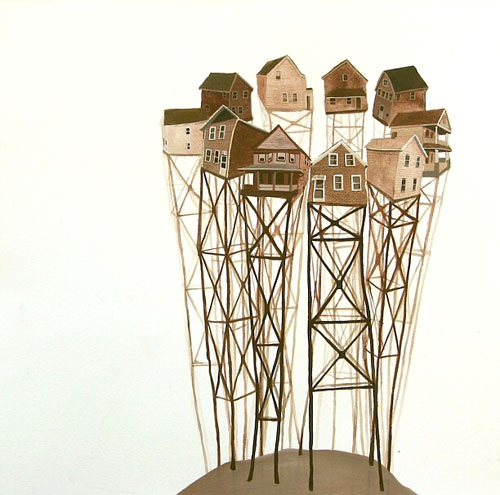

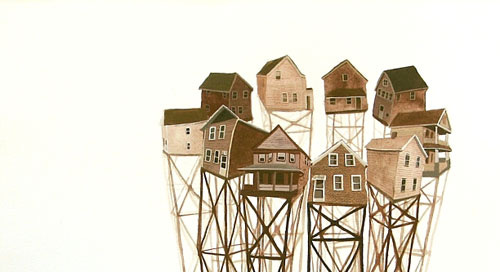

The result? A new kind of innovation, nimble enough to ride the waves, sturdy enough to remain in one piece, or if necessary break without being smashed to pieces.

Something early whaling boats did not manage to hack.

Building nimbly makes you see the big and small picture at the same time. It also forces you to think about the unseen picture - what other non-building components of the system a.k.a governments are thinking.

It’s not ideal, but Africa’s entrepreneurial system is still in the Middle Ages where one season of sour weather can guarantee famine and inspire history-shifting revolutionary movements. In that sense, it is good news.

The real implication is that if you are building for Africa or supporting African builders a.k.a VCs, you need to roll up your sleeves and prepare for life in the trenches. After all, good ventures, like whaling expeditions, need a few bruises here and there to make a good story.

Like Makoko, African startups are romanticized until they are not, which is often the case when your product is smacked repeatedly in the face with one obnoxious reality after another.

Still, sometimes for Africa’s builders, life comes at you so fast, you forget which feet to place in front of the other.

Literally.

The first challenge for founders is being realistic enough - choosing strong enough stilts, and quickly developing sea legs that are nimble enough to navigate the many turns that is our Makoko.

Some heroes build on thin air. Like this online livestock trading business. Agrikaab, formerly Ari Farm, sold and raised goats to and for its crowdfunding “investors” spread across than 35 countries. Agrikaab even accepted bitcoin investments.

In April 2019, Agrikaab survived a literal bomb explosion after its offices in downtown Mogadishu were damaged in one of the many terrorist attacks that rocked the busy Maka l-Mukarama road.

Where bombs couldn’t take it down, export restrictions, an unstable political climate, and food shortages succeeded in shuttering most of Agrikaab’s business.

Strictly speaking, building on thin air should be the exclusive preserve of genies, but African builders manage to do both that and more. And it’s not always about having enough cash, although that is very welcome, thank you. As you quickly find out in Africa, throwing cash at problems is both a rare privilege and a severely limited genie.

In the end, “disruptors” in Africa are not few and far between, they are everywhere. They are not “disrupting” traditional systems that worked well in the past. They building entire new ecosystems that will carry the solutions Africa desperately needs.

They are all disrupting the giant ogre of Nothing. Terrifying?

I started this newsletter to share the stories of startups facing, and navigating these challenges, and the VC who like their whaling venture forbears bravely support them. Our next piece will hopefully share the RelianceHMO story.

Who else do you want me to talk to? Tell me.

While writing this, Risevest, Bamboo, and their fellow shipmen, just got hit with a broadside from Nigeria’s Securities and Exchange Commission (SEC), which is a story that will definitely be told here. Keep an eye out for that.

i love your articulation of your view on startups in nigeria... I would love to connect... mind sharing your email?

So eloquently explained! Thank you.